24hr Emergency Service Call: +1 713 992 6664 / +1 713 909 0122

WTI crashes below $0 a barrel — a record low

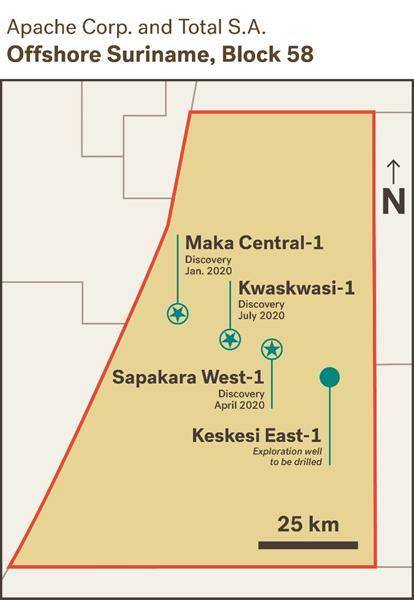

Apache Makes ‘Significant’ Discovery Offshore Suriname

April 3, 2020

Guyana Has No Plans to Cut Crude Output

May 5, 2020By Jazmin Goodwin and Laura He, CNN Business

Updated 5:52 AM ET, Tue April 21, 2020

New York/Hong Kong (CNN Business)Oil prices are still crashing after a stunning collapse Monday that saw US crude futures plunge below zero for the first time in history.The pain in oil markets is carrying over to stocks, with Asian and European indexes, and US stock futures, all in the red on Tuesday. US oil futures for May delivery were last trading below $0 again after briefly popping above $1 a barrel. The May contract, which expires Tuesday, finished regular trading Monday at -$37.63 a barrel.The West Texas Intermediate June contract, which is now being traded more actively, crashed more than 11% to $18.14 a barrel. Brent, the global benchmark, also plummeted nearly 22%, last trading at $19.92 a barrel.

The coronavirus pandemic has caused oil demand to evaporate so rapidly that the world is running out of room to store barrels that nobody wants. A new agreement a little over a week ago by Saudi Arabia and Russia — with other producers — to cut supply by a record amount has failed to convince traders that the supply glut will ease any time soon.

The market will likely continue to be pressured in the coming weeks, wrote Bjornar Tonhaugen, head of oil markets at Rystad Energy, in a research note Tuesday. He noted that the OPEC+ cuts only go into effect in May. And while the group has agreed to cut oil production by historic amounts, Tonhaugen said the market needs to see a lot of additional cuts to account for a massive decline in demand for oil. Global stocks also recorded big declines Tuesday. The FTSE 100 (UKX) is trading 1.4% lower in London. Germany’s DAX (DAX) and France’s CAC 40 (CAC40) are both down 1.8%.Hong Kong’s Hang Seng (HSI) tumbled 2.2%, while Japan’s Nikkei 225 (N225) fell nearly 2%. China’s Shanghai Composite (SHCOMP) lost 0.9%.South Korea’s Kospi (KOSPI) tumbled nearly 3% and the won slipped as much as 1.7% against the US dollar as CNN reported — citing a US official with direct knowledge — that the United States is monitoring intelligence that suggests North Korean leader Kim Jong Un is in grave danger after undergoing a previous surgery.South Korea’s Presidential Blue House said in a statement provided to reporters that they have nothing to confirm on reports about Kim’s health and that “no unusual signs” have been detected inside North Korea.The Kospi pared losses to close down 1%. The won also recovered somewhat, though was still weaker against the dollar compared to Monday.Regional markets have only priced in “a small-ish reaction to the [North Korean] news,” wrote Jeffrey Halley, senior market analyst for Asia Pacific at Oanda, in a Tuesday research note. But he added that if it proves to be correct “the region is set for a period of uncertainty.”US stock futures reversed early gains. Dow futures were last down 264 points, or about 1.1%. S&P 500 futures dropped 0.7% and Nasdaq futures were down about 0.2%.The Dow (INDU) closed 592 points lower, or 2.4%,on Monday, marking the worst day for the index since April 1. The S&P 500 (SPX) finished down 1.8% and the Nasdaq Composite (COMP) closed 1% lower.

Notice: Trying to access array offset on value of type null in /home/u937667962/domains/marineworldsolutions.com/public_html/wp-content/themes/betheme/includes/content-single.php on line 286